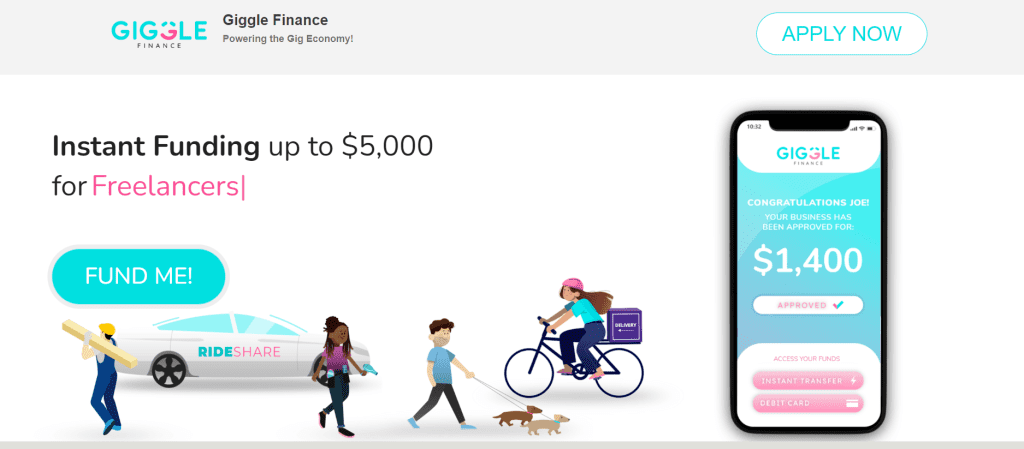

A financial technology firm called Giggle Finance has developed an online loan platform to make it easier for small business holders and gig economy employees to rapidly access up to $5,000. You must be self-employed with a work history of at least three months and earnings of more than $3,000 per month in order to train for a loan (officially, a cash advance “revenue-based financing program”).

We questioned Jared Kogan, a co-founder of Giggle Finance, about the motivation behind the business as well as his own quick description of the platform.

After noticing the limited options available on the market, Kogan remarked, “We founded Giggle to assist 1099s and gig workers with access to funding.” “Independent employees are the future of employment, and we’re here to provide all of their financial needs in one convenient location. With an application to the funding process that takes less than 10 minutes, our efficiency and openness support the independent workforce’s continued success.

How Giggle Finance Works?

Customers who are self-employed 1099 workers or entrepreneurs searching for small amounts of financing to support their expansion are the focus of Giggle Finance. Giggle gives what it refers to as a “Giggle Advance,” which is a cash proceed for businesses (or merchant cash advance). Borrowers with bad personal and company credit can get loans from Giggle. (It’s a good idea to build business credit scores, though, to help you become eligible for other small business loans with possibly cheaper interest rates.

To establish company credit, start with Nav’s instructions. Giggle Finance is the greatest option for gig workers looking for a small loan because you may borrow up to $10,000 from them (new business owners are typically only eligible for $5,000). You must use Stripe to securely connect your bank account as part of the quick application procedure. The money will then be able to deliver right away, and you should receive approval or denial almost immediately. You can receive the money via bank transfer or debit card.

Your payments to Giggle will automatically withhold from your bank account based on your projected future sales. Keep in mind, however, that company cash proceeds are infamously pricy. Using an element rate, which is a multiplier of the beginning sum, you pay a percentage of each day’s sales when you receive business cash proceed. The element fare for giggles typically ranges from 1.15 to 1.7. For example, if your element rate is 1.5 and you borrow $5,000, your total repayment amount will be $7,500. Your future bargain will automatically subtract this amount.

Your agreement with Giggle Finance will determine the specific terms and costs, so be sure you are completely aware of everything before you sign anything. If you make your payments ahead of schedule, you can be able to give a discount.

How Can I Receive Advance Cash From Giggle Finance

One who works as a contractor may be able to entitle for a Giggle Advance. Its company cash advance doesn’t involve a credit check, unlike some other personal loan options, and the cost can be less expensive than payday loans. With a Giggle Advance, every borrower, including independent contractors, agrees to return a portion of their future sales to Giggle in exchange for very immediate liquidity.

Is There Any Limit To Qualifying In Giggle Finance?

Along Giggle Finance, you may be capable of up to $10,000 in cash, however, it’s typically only $5,000 for beginning business owners who can’t look solid financials. Your unique situation and eligibility, including elements like your monthly income, will determine the precise amount you can get. The likelihood that you will be able to acquire the full amount funded typically increases with your monthly income. Giggle decides how much cash you will receive after taking into account your ability to repay the complete loan on time.

How To Apply For Giggle Finance?

Through Giggle’s website, small business owners can submit an online application; the entire procedure takes less than eight minutes. During the application procedure, you must safely connect your bank account. Giggle doesn’t save any of your information and employs 256-bit encryption. Be careful you read any product disclosures and comprehend the payment schedule and terms before applying.

As soon as your application is capable to approve, which can happen fairly immediately, Giggle can deliver funding via a bank transfer almost immediately. It can take longer if you prefer to get your money via a debit card. A small business owner, freelancer, or member of the gig economy who needs a little amount of financial assistance that they can’t receive elsewhere may benefit from using Giggle Finance.

Giggle funds can be able to use in a variety of ways. A rideshare driver might pay for car maintenance, while a freelancer might hire an assistant. Business cash advances are typically more expensive than some other solutions, so it’s crucial to shop around and consider all of your possibilities. Searching for company credit cards is an alternative; explore your top choices by registering with Nav. But if Giggle can help you expand your company and you don’t qualify for less expensive options because of poor credit or a short business history, it can be worthwhile to look into Giggle Finance.

Conclusion

Nearly half of all US workers are self-employed, independent contractors, or small business proprietors. If you belong to this group of hard-working Americans, you are probably aware of how challenging it can be to obtain a loan from a local bank because those institutions want to have a pay stub and a stable income coming from a huge organization that employs many people.

Fortunately, more fintech businesses are filling this gap to give 1099 contractors and small business owners better access to money and a lot less paperwork. And Giggle Finance is one of these young companies that have a rising amount of favorable Google reviews. We wrote this post to inform you about Giggle Finance, and how it functions, and to assist you in determining whether or not you ought to think about requesting a Giggle cash advance at this time or in the future.